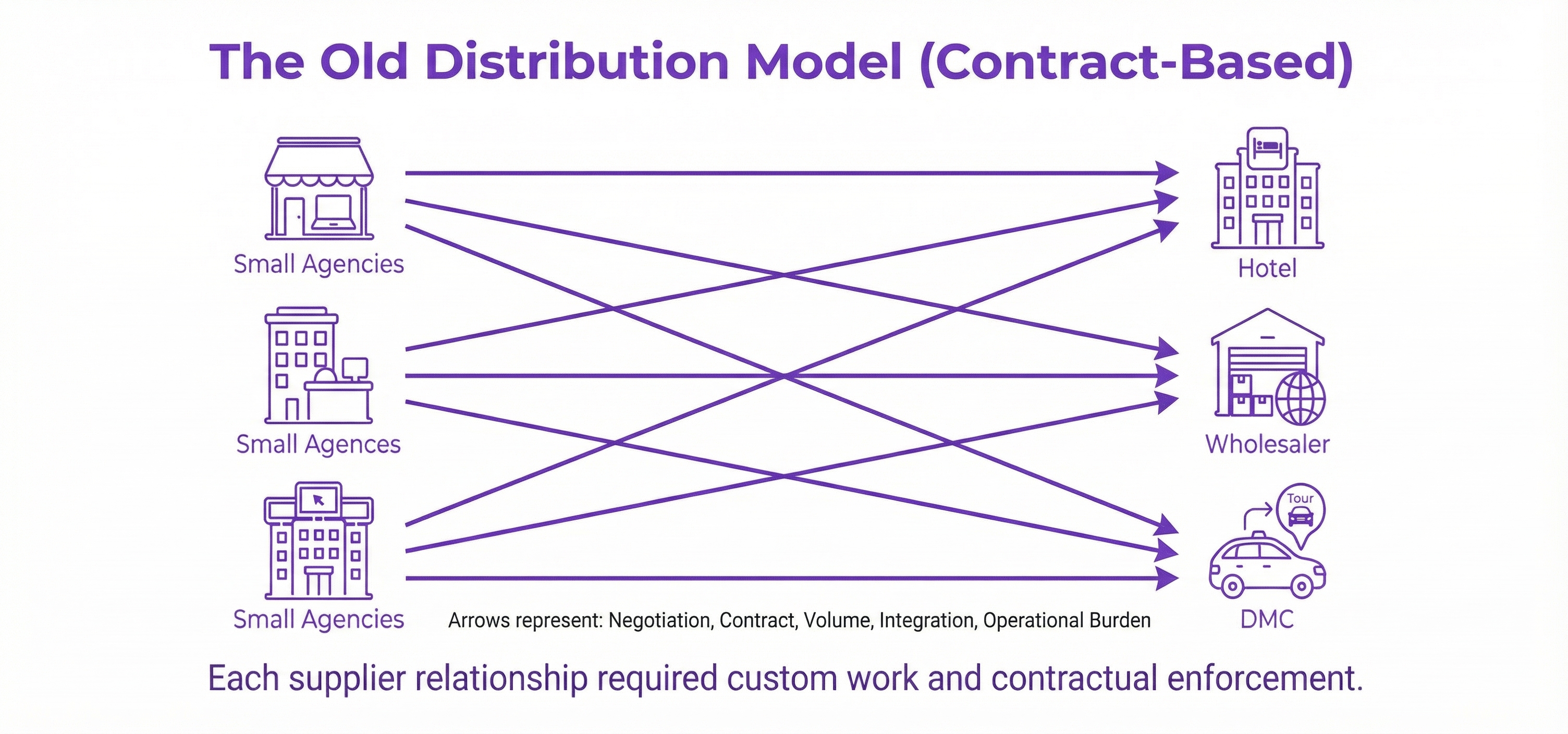

For most of the internet era, launching a travel business meant entering a world with its own rituals. You negotiated with wholesalers. You filled out forms. You promised minimum volumes you weren't sure you could deliver. You learned which suppliers preferred email and which wanted faxed amendments long after the rest of the world had moved on.

The industry wasn't intentionally hard to enter; it was simply built on foundations poured decades before modern connectivity, pricing automation, or dynamic distribution. Suppliers managed risk with contracts because there was no other reliable mechanism. Agencies learned to work around siloed systems because that was the only way to access inventory.

Today, however, something more fundamental is happening beneath the surface. The technology layer that underpinned the old model is being quietly replaced. And for the first time in travel's history, a business can meaningfully operate without signing a single supplier contract.

This isn't a shortcut or a trick. It's a sign that the infrastructure of travel distribution is undergoing the same shift that transformed commerce, media, and fintech: complexity is moving from the edges of the system into the centre.

1. Why Supplier Contracts Existed in the First Place

Long before APIs and structured pricing, wholesaler contracts were the glue that kept a fragmented industry functioning. They solved several intertwined problems, many of which had nothing to do with bureaucracy and everything to do with protecting the economics of travel.

Stopping B2B Rate Leakage

The biggest threat to a supplier wasn't a poor-performing agency. It was leakage: wholesale rates meant for packages and trade partners slipping into public consumer channels.

This mattered because:

- Wholesale rates are intentionally lower than retail

- OTAs (Online Travel Agents) like Booking.com demand parity

- Hotels defend rate integrity fiercely

- A leaked rate can cascade through metasearch almost instantly

Contracts were the only leverage suppliers had to prevent downward price erosion.

Guaranteeing Predictable Volume

Suppliers offered discounts in exchange for volume. Contracts provided a way to forecast demand months ahead, especially in a world where seasonality and tour operations dominated.

Ensuring Agencies Could Operate Responsibly

Before automation, each booking carried friction:

- Cancellations and modifications required manual handling

- Misrepresented rooms led to costly guest issues

- Incorrect tax calculations caused settlement disputes

- Fraud detection was inconsistent at best

Contracts acted as vetting mechanisms: "If you want access to discounted inventory, prove you can operate at the industry's standard."

Overcoming Technical Fragmentation

The travel industry grew through layers of incompatible technology: legacy bedbanks, hand-built APIs, proprietary schemas, and channel managers with different philosophies about data.

Contracts determined who could access what—and under what technical conditions.

Managing Financial Exposure

When agencies became the merchant of record, suppliers were exposed to credit risk, settlement risk, and chargeback volatility. Contracts defined payment schedules, credit limits, and liabilities.

Without them, suppliers were flying blind.

2. The Shift: From Contractual Access to Programmatic Access

In the last few years, a silent realignment has occurred. Suppliers didn't suddenly become more generous; rather, the economic and technical framework around them changed.

Three shifts matter most:

1. Connectivity is becoming standardised

APIs have finally replaced spreadsheets, faxes, and proprietary protocols like GDS. This lowers the cost of distribution and makes direct relationships less essential for basic access.

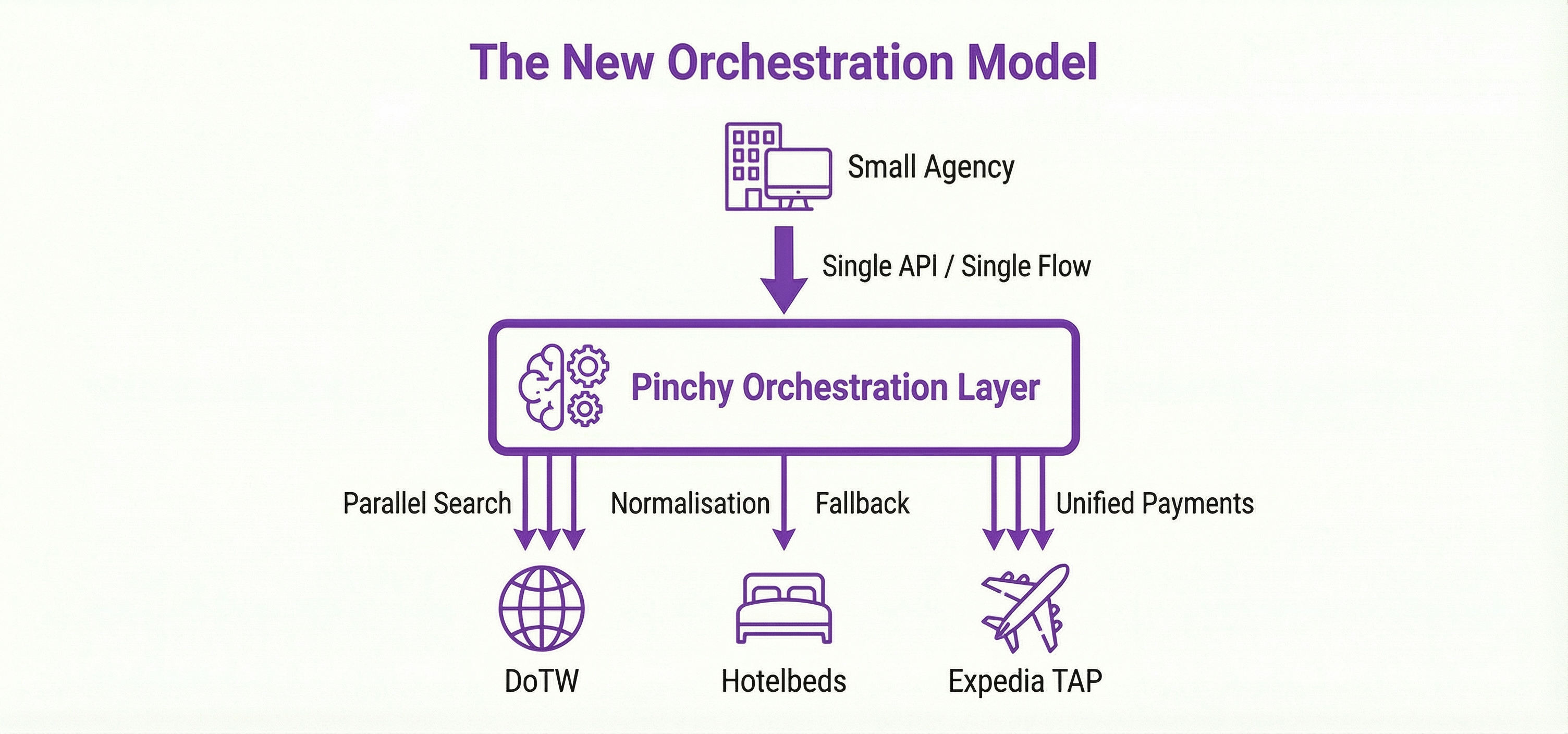

2. Orchestration layers centralise what agencies once handled

Instead of every agency integrating with every supplier, an orchestration platform integrates once, maintains those connections, and exposes a unified API.

Pinchy's strategic vision describes this clearly: "An AI-native orchestration layer that connects any supplier to any channel."

This is not a cosmetic improvement. It fundamentally changes where complexity lives in the value chain.

3. AI is taking over the stabilising functions once handled by contracts

In the old model, contracts enforced:

- correct rate display

- correct room mapping

- correct use of inventory

- acceptable cancellation handling

- predictable performance

In the new model, these are technical problems, not contractual ones.

Machine-driven systems can:

- detect mapping inconsistencies

- route around supplier failures

- normalise room data

- flag anomalies in pricing

- automatically choose the best commercial model (net or commission)

Where suppliers once relied on paperwork, they can now rely on computation.

3. What Launching Without Supplier Contracts Actually Means

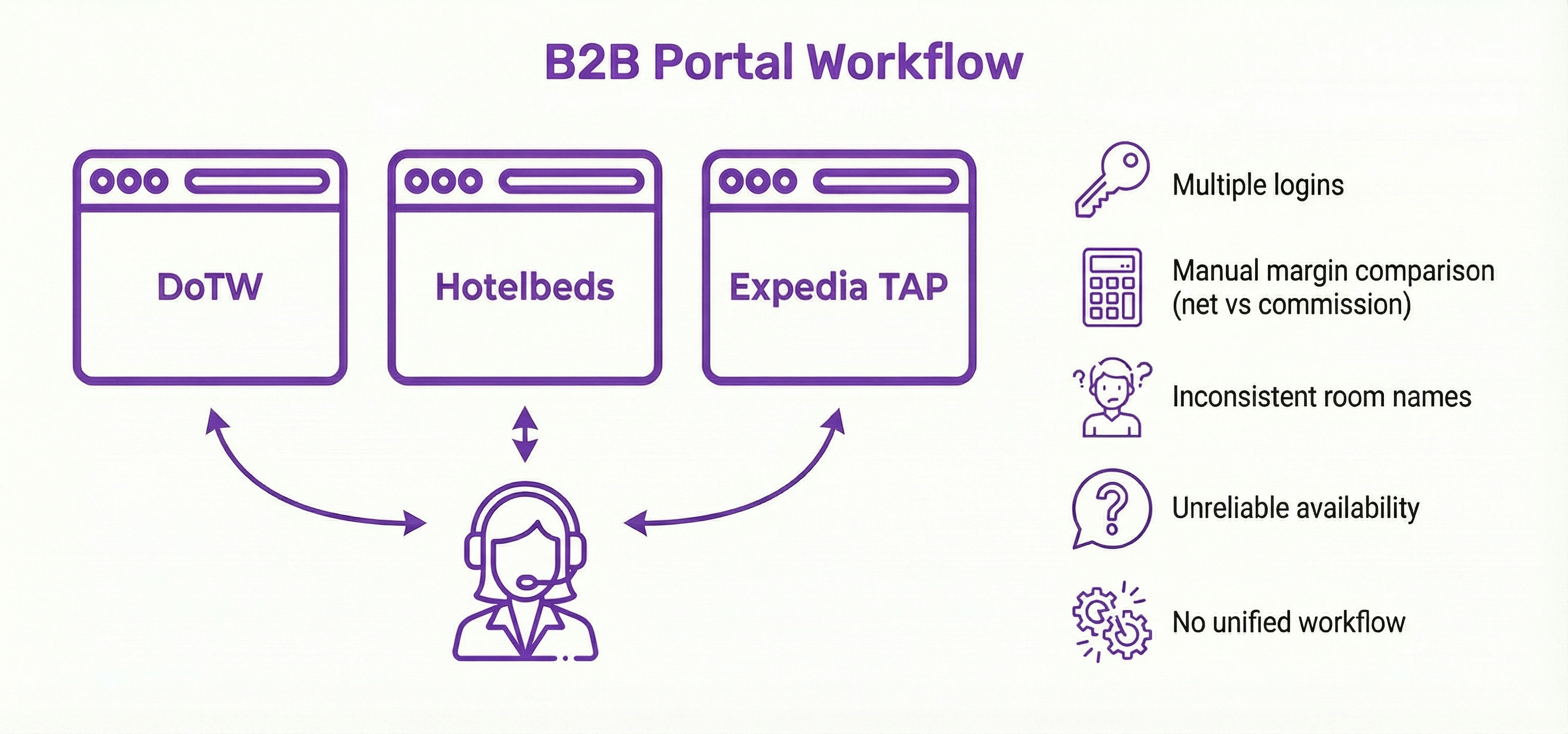

To see how transformative this is, look at how many small agencies work today. Lacking direct contracts, they rely on B2B portals such as Destinations of the World, Hotelbeds' web interface, or Expedia TAP.

These systems were life-changing when introduced—but they created a new problem: fragmentation.

An everyday booking involves:

- logging into multiple supplier portals

- running identical searches

- comparing net rates against commission-based ones

- interpreting mismatched room names

- cross-checking policies formatted differently

- calculating margin manually

- dealing with failures supplier-by-supplier

The agent isn't just booking. They're translating between micro-systems that were never designed to interoperate.

How the orchestration model rewrites this

Instead of dozens of portals, the workflow becomes:

Search once → Orchestration layer → Unified results

Behind the scenes the platform:

- queries suppliers in parallel

- normalises rooms and rate structures

- reconciles net vs commission models

- ranks results based on margin, reliability, and availability

- applies fallback when a supplier fails

- handles payment logic consistently

The agent no longer acts as the connective tissue between incompatible systems.

4. A Practical Path: Launching a Travel Business with No Agreements

A contract-free model isn't a shortcut; it simply reflects a more modern set of infrastructure assumptions.

Step 1: Decide what you actually want to offer

Travel businesses win today through curation, identity, and expertise—not access to inventory. The market no longer rewards generalists; it rewards focus.

Step 2: Use programmatic access to supply

Platforms like Pinchy give immediate access to:

- multiple suppliers

- a unified schema

- reliable booking flows

- upstream risk and compliance management

- AI-driven routing logic

Access becomes a technical function, not a commercial negotiation.

Step 3: Choose your channel

The orchestration layer lets you build in any direction:

- a white-label OTA

- a custom booking interface

- a WhatsApp travel concierge

- a niche membership club

- a browser extension surfacing better deals

- a micro-agency for a specific community

The constraints now sit in the imagination, not the infrastructure.

Step 4: Go live

A process that once took months—supplier outreach, contract negotiation, credit line setup, technical integrations—compresses into days or hours.

5. Why This Matters: The Economics Have Changed

When the machinery of travel becomes centralised and abstracted, the industry opens up.

Lower startup friction = more experimentation

Founders can test ideas without committing to large operational footprints.

Niche distribution finally becomes viable

Communities, creators, local experts, and verticalised micro-agencies can exist next to OTAs, not beneath them.

Shared intelligence compounds value for all participants

Pinchy calls this the Travel Demand Graph: every search, click, match, fallback, and booking improves the system for the next user.

This used to be a competitive advantage reserved only for giants like Booking Holdings or Expedia Group.

6. What Becomes Possible Now?

With contracts out of the way and orchestration absorbing complexity, travel becomes modular—something that can be embedded anywhere.

This unlocks:

- creator-owned travel brands

- AI-powered travel assistants

- fintech apps that incorporate travel perks

- founders building niche, high-margin micro-agencies

- hyperlocal travel experiences curated by experts

- specialty OTAs tailored to communities or interests

The question shifts from "How do I negotiate my first contract?" to "What kind of travel business do I want to build, and for whom?"

Conclusion: Travel Is Entering Its Programmable Era

Travel has always been a complex industry, but for decades that complexity lived at the edge—in every agency, every booking, every reconciliation of supplier quirks.

Now that complexity is moving to the centre.

Orchestration layers don't merely aggregate supply; they absorb the technical, commercial, and operational burdens that once made supplier contracts essential. That shift rewrites who can participate in the industry and what kinds of businesses can be built.

Travel is finally aligning with the architecture of the modern internet: modular, programmable, and open to anyone with an angle and access to an audience.

The entrepreneurs who embrace this shift won't just start travel businesses—they'll reshape what the category even means and deliver the first meaningful challenge to the legacy OTAs.